Reconciling Your Checking Account Helps You Discover Mistakes and Rectify Them Quickly.īanks make mistakes. While you don’t have a formal check register to balance, you still need to reconcile your records with your bank statement for a few key reasons, two of which follow. Then the bank sends us a monthly statement for our records. Our paycheck is direct deposited into it, our debit card is linked to it, and we pay our bills online from it. While most of us no longer carry around checks and record expenses by hand in a check register booklet - some of us rarely even write a check - we still use a traditional checking account as our primary bank account. You corrected any errors, like deducting the amount of the check you forgot to write down and subtracting bank fees charged to you, and reconciled your account.

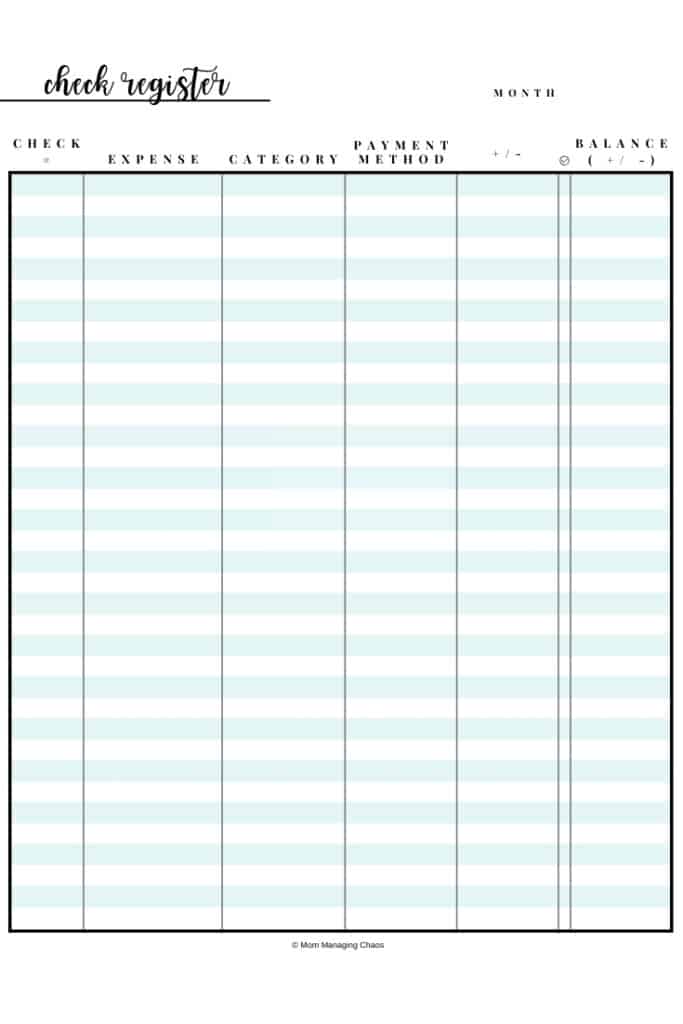

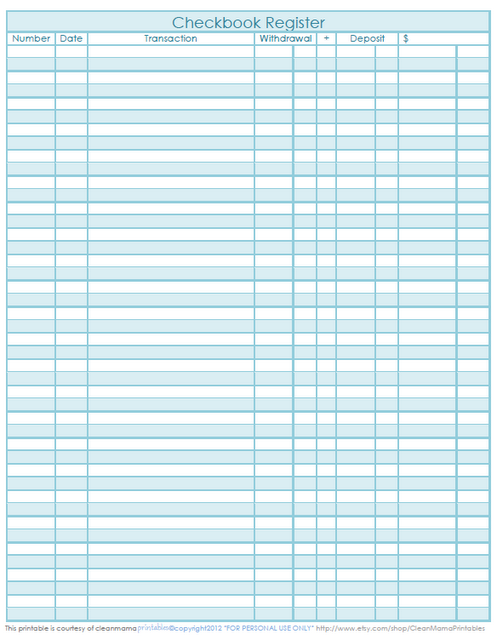

You’d also keep track of deposits and withdrawals you made during the month in your check register.Īt the end of the month, you’d take your checking account statement and your check register and match up your entries with your bank’s records. When you'd write the check, you'd note the date, amount and merchant in your check register. You’d write a check the merchant would take to the bank with his other deposits, and the bank would cash the check, deducting the money from your account. In the days before the ease and convenience of credit cards, debit cards and direct deposit, people carried a checkbook (a stack of checks along with a check register journal). Most of us dread the task… if we do it at all. Balancing your checkbook seems like an old-fashioned task, but is it still something you need to do?

#Balance a checkbook download

We live in a time when you can keep your calendar on your phone, carry your debit card in your back pocket, download a personal finance app to keep track of your spending on the go, even sign important documents electronically. We may receive compensation when you click on links to those products or services This article/post contains references to products or services from one or more of our advertisers or partners.

#Balance a checkbook how to

0 kommentar(er)

0 kommentar(er)